Accounting for freelancers: a complete guide to bookkeeping for the self-employed

As a freelancer, you’re your own boss. It’s liberating, but it also means you’re responsible for your finances. Freelance bookkeeping is crucial for maintaining control over your business’ finances and ensuring you meet your tax obligations. In this guide, we’ll dive into the essentials of accounting for freelancers, covering everything from tracking income and expenses to managing invoices and preparing for taxes.

The importance of freelance bookkeeping

Bookkeeping for your small business isn’t just about fulfilling legal requirements—it’s about gaining insight into your business’ finances. By keeping accurate records, you can track your income and expenses, identify areas for growth, and make informed decisions about your business’ future. Plus, come tax time, organized financial records will save you time, stress, and potentially money.

Keep an accurate record of freelance income and expenses

Tracking your freelance income and expenses is the foundation of effective bookkeeping. Every payment you receive and every business-related expense you incur should be recorded. This includes invoices, receipts, and any other financial documentation. By maintaining detailed records, you’ll have a clear understanding of your business’ cash flow and profitability.

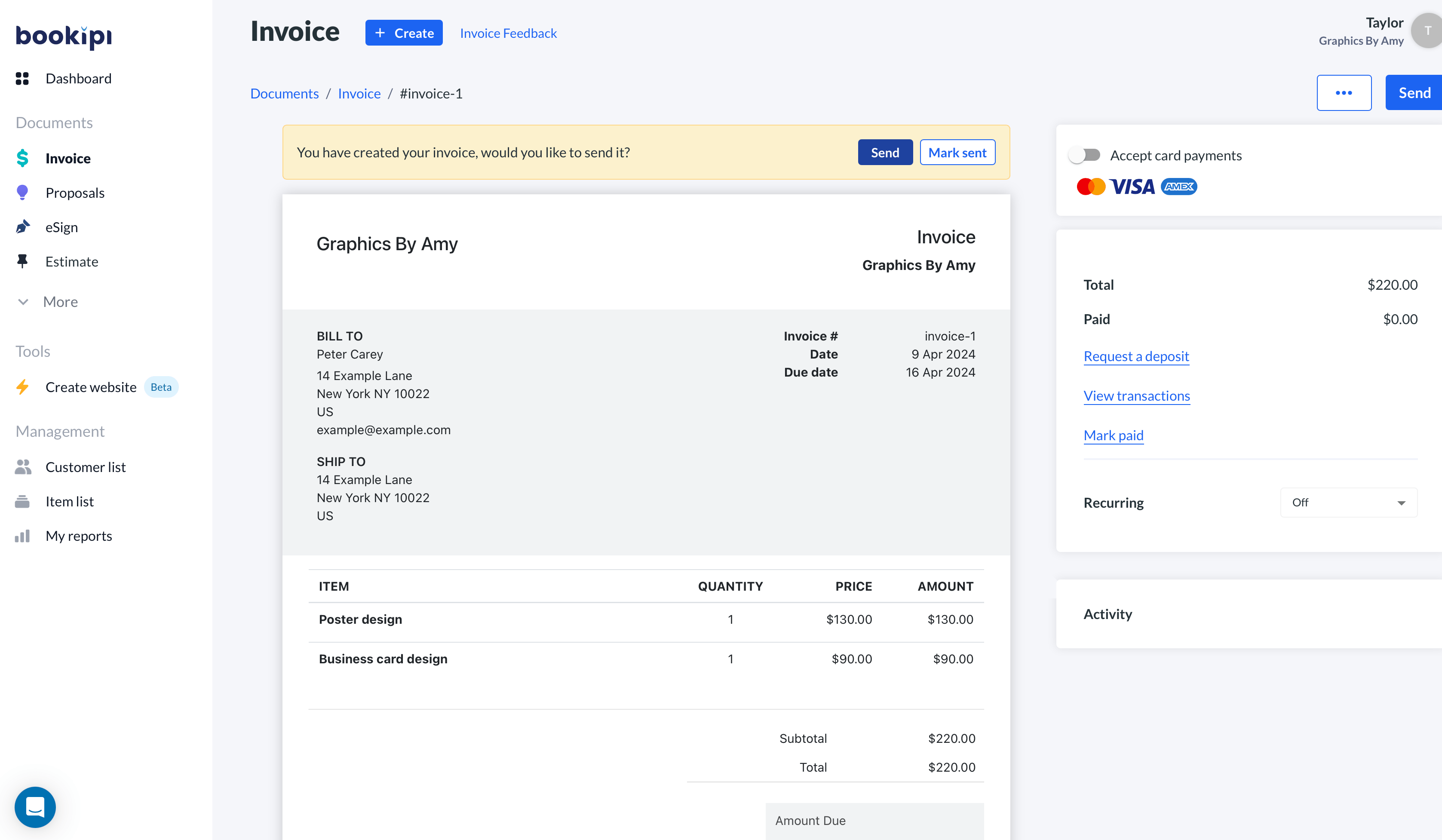

Create and manage invoices

Invoicing is how you get paid as a freelancer, so it’s essential to get it right. Create professional-looking invoices with an invoicing software like Bookipi that clearly outlines the services you’ve provided, payment terms, and how clients can pay you. Invoicing softwares like Bookipi streamline the invoicing process and ensure prompt payment. Remember, timely and accurate invoicing is key to maintaining positive cash flow.

Set money aside for your taxes

As a self-employed individual, you’re responsible for paying your own taxes. It’s vital to set aside a portion of your income throughout the year to cover your tax obligations. Open a separate bank account specifically for tax payments and regularly transfer funds into it. This way, you’ll avoid the stress of scrambling to pay your taxes come tax filing season.

10 Accounting tips for self-employed freelancers

1. Keep personal and business finances separate

Mixing personal and business finances can lead to confusion and complicate your bookkeeping. Maintain separate bank accounts and credit cards for your business to keep things organized. This clear distinction not only streamlines your financial record-keeping but also ensures transparency and facilitates accurate tax reporting, making it easier to track business expenses and deductions. Mixing your business and personal finances makes it harder to track your profits and business expenses if everything is in the same account, potentially leading to missed deductions and inaccuracies in your financial reports.

2. Stay on top of your expenses

Track your business expenses diligently. This includes everything from office supplies and equipment to travel and client entertainment. Remember, many expenses are tax-deductible, so keep all receipts and records. It’s also helpful to categorize your expenses to ensure accurate reporting and maximize your deductions. Using an accounting software like Bookipi to streamline the process and capture expenses in real-time, reducing the likelihood of overlooking deductible items. By maintaining detailed records and staying organized, you not only optimize your tax savings but also gain valuable insights into your spending patterns, allowing you to make informed financial decisions for your freelance business.

3. Regularly review your financial records

Set aside time each week or month to review your financial records. This will help you spot any discrepancies or trends so you can make informed decisions about your business. Analyzing your financial data regularly allows you to identify patterns in your income and expenses, enabling you to adjust your budgeting and spending accordingly. It also provides valuable insights into the financial health of your business, helping you track progress towards your goals and identify areas for improvement. By staying proactive and engaged with your finances, you can maintain control over your business’s financial path and ensure its long-term success.

4. Automate where possible

Take advantage of accounting software and apps like Bookipi to automate repetitive tasks like invoicing, expense tracking, and reconciling accounts. This will save you time and minimize the risk of errors. Automation can provide valuable insights into your financial data, allowing you to identify trends, track your business’s performance, and make informed decisions. By using technology to streamline your accounting processes, you can focus more of your time on growing your business and serving your clients effectively.

5. Invest in your business knowledge

The more you understand about small business, accounting and finance, the better equipped you’ll be to manage your business’ finances effectively. Consider taking a course or workshop to improve your financial literacy, and take advantage of helpful online resources for small businesses. Networking with other freelancers and small business owners can provide valuable peer support and opportunities for learning from shared experiences. Remember, knowledge is power, and arming yourself with a solid understanding of business fundamentals will empower you to make informed decisions and steer your freelance career toward success.

6. Plan for irregular income

The predictability of regular work is not always guaranteed for freelancers, so it’s normal to experience fluctuations in income. Budget accordingly and set aside funds during peak earning periods to cover expenses during slower months. Additionally, consider diversifying your income streams to ease the impact of irregular income. Explore opportunities for recurring revenue, such as retainer agreements or subscription-based services, to provide a more stable income foundation.

7. Monitor your cash flow

Cash flow is the lifeblood of your business. Keep a close eye on your cash flow statement to ensure you have enough liquidity to cover your expenses and obligations. It’s also important to keep on top of your invoices, and follow up on outstanding payments to protect your business.

By staying on top of your cash flow, you can avoid financial problems and keep your business running smoothly.

8. Keep your tax filings up to date

It’s important to file your taxes on time to avoid fines and discrepancies in your paperwork. Stay organized throughout the year, and consider hiring a professional accountant or tax preparer to help ensure your filings are accurate and timely. Working with a tax professional can provide peace of mind and confidence that your tax returns are prepared correctly, saving you time and money in the long run.

9. Review your pricing regularly

Regularly assess your pricing structure to ensure you’re charging enough to cover your expenses and generate a profit. Freelancers often underestimate the true cost of their services, including overhead expenses such as equipment, software subscriptions, and marketing efforts. By regularly reviewing and adjusting your pricing, you can ensure that your rates align with the value you provide, compensating you for your time and expertise. Here are some tips on how much to charge as a freelancer.

10. Plan for growth

As your freelance business grows, your accounting needs will evolve. Stay proactive and anticipate changes in your financial needs, whether it’s investing in new software or hiring additional help. Regularly review and update your budget and financial projections to align with your goals, ensuring that you’re prepared for increased expenses. By planning for growth and adapting your accounting practices accordingly, you’ll position your freelance business for long-term success in a competitive market landscape.

Make bookkeeping work for you

Bookkeeping doesn’t have to be a headache. With the right tools and mindset, you can make it work for you. Bookipi offers intuitive and user-friendly accounting software designed specifically for freelancers. From invoicing to expense tracking to tax reporting, Bookipi streamlines the entire process, saving you time and ensuring accuracy. With Bookipi, you can focus on doing what you love while keeping your finances in check.

Accounting for freelancers is a vital aspect of running a successful freelance business. By keeping accurate records, managing your finances effectively, and leveraging tools like Bookipi, you can take control of your financial destiny and build a thriving freelance career.

Table of Contents

Automate your bookkeeping with Bookipi, freelancers love us for our ease of setup and accessibility on mobile and desktop web app!

Frequently asked questions (FAQs) about accounting for freelancers

Is it worth using an accountant as a freelancer?

While you can manage your finances on your own, an accountant can provide valuable guidance and expertise, especially as your business grows. They can help you maximize deductions, ensure compliance with tax laws, and offer strategic financial advice.

What can freelancers claim on their tax write off?

Freelancers can typically deduct business-related expenses, including office supplies, equipment, travel, and marketing expenses. However, it’s essential to keep accurate records and consult with a tax professional to ensure compliance with tax laws.

How can a freelancer get paid faster?

To expedite payments, set clear payment terms and follow up promptly on overdue invoices. It’s important to format your invoices properly and be clear about when an invoice payment is due. Consider offering incentives for early payment, such as discounts or preferred pricing.

Is Bookipi People available on both iPhone and Android devices?

Yes, our rostering app is available on both iPhone and Android devices. Simply download Bookipi People from the App Store or Google Play Store to get set up. Our roster app is also accessible on the web app and synced across devices to ensure a consistent experience for you – use it the way you want.

Do self-employed freelancers need accounting software?

While it’s possible to manage your finances manually, accounting software can streamline the process and minimize errors. Look for a freelance invoicing app, like Bookipi, which offers features tailored to your unique needs.

How often should freelancers do their bookkeeping?

It’s best to stay on top of your bookkeeping regularly, whether it’s weekly, bi-weekly, or monthly. Regular maintenance ensures accuracy and allows you to identify and address any issues promptly.

How much do freelance accountants or bookkeepers cost?

The cost of hiring a freelance accountant or bookkeeper varies depending on factors like experience, location, and the scope of services required. Rates can range from hourly fees to monthly retainers. Consider your budget and the level of support you need when hiring professional help.

Explore related articles: