Do you need insurance if you are a small business?

“YOU BROKE IT, YOU BOUGHT IT!” is one of the worse things you can hear during an accident in any kind of store. And goodness, please do not let it happen in one of those expensive stores you had nooooooo business going into anyway! Well, when you are planning your business, keep that one uncomfortable statement in mind. Why? Because this will be the determining factor as to whether business insurance is essential for your business or not. Whether you are in the planning stage of your small business or you have already launched your small business (and have not purchased business insurance), here are a few tips to determine if business insurance is right for you.

What are you selling?

Because of the sudden craze of eating healthy and making healthier lifestyle choices, people are taking advantage of the monopolization of hand-made soaps, lotions, shampoos, clothing, drinks, and more. These businesses/people are also marketing their brands with logos, business names, websites, and/or social media pages. All of these are reasons Product Liability Insurance is essential for your small business. Why? Because accidents are human nature. Mistakes happen… Mislabeling happens… Errors happen.

It only takes one accident in a product you are advertising and selling to land you and your business in bankruptcy because of “damages”. And, yes, I have been told by a few start-up business owners, “No, I do not have business insurance, but I ensure customers know they are purchasing products at their own risks/will”. Let me enlighten you a little bit on the law; this does not remove you from any liability, nor will that hold up in court. If you are promoting yourself as a business at any capacity, legally, you are a business (even if unofficial to your state or IRS) and you bear responsibility for your product(s). I recommend talking to a business attorney and/or an insurance agent to ensure you are properly informed.

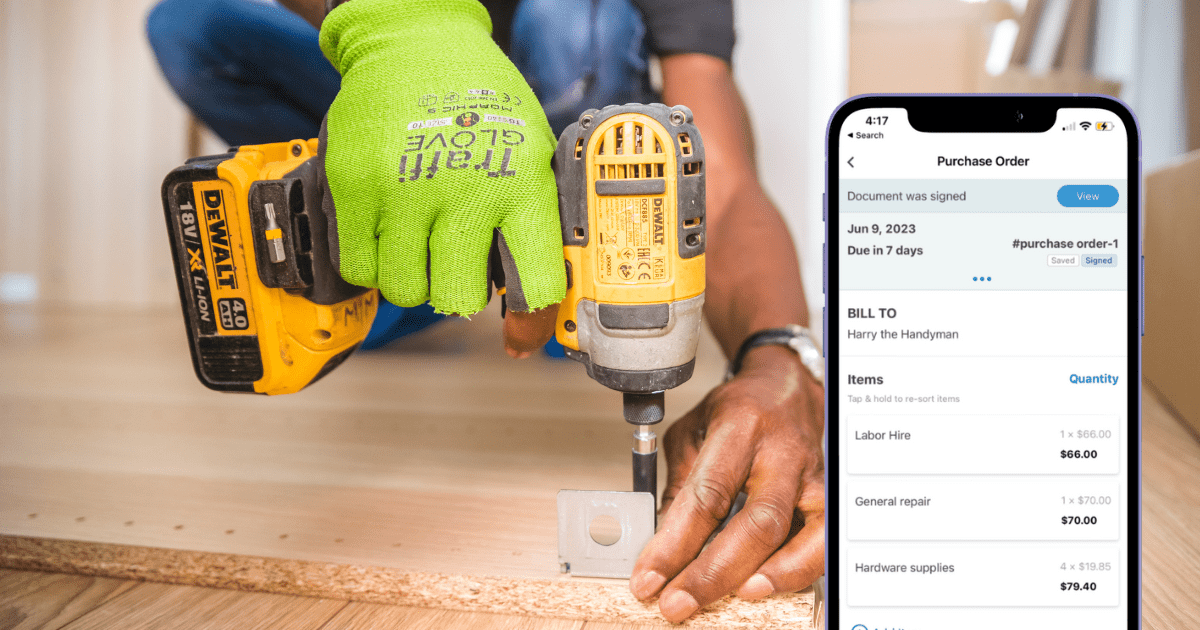

Do you or will you have employees?

![]()

Whether or not to have employees requires quite a bit of thought, quite a bit of planning, and quite a bit of money. From the moment you decide to have an employee, most (if not all) states require you to provide workman’s compensation benefits to them. But exactly where do these benefits come from and who pays for them?

Well, the answer is easy. Either your business pays or Workman’s Compensation Insurance pays; which typically covers medical care, disability and/or death benefits of employees (or a single employee) if they are injured or die as a result of his/her work while working within your business.

Naturally, all fast-food, chain restaurants, construction companies, and other high-risk injury jobs have workman’s compensation insurance. But a small business that hires one part-time social media person for an employee may not realize there are still risks for injury or disability of that employee. Sounds a bit crazy, right?

If in your mind, you are wondering what type of injury could possibly occur sitting at desk or on a phone that could cause injury, let me provide some examples: carpal tunnel syndrome, slip and fall, a sprained ankle, or other workplace hazard that may take place (even in a small business operated within a home-based office). So, while injuries may not be as drastic as a grease burn or a major construction injury, ensure you know the risks and liabilities of your small business. Protecting yourself is protecting the long-term growth and success of your business.

Is your office in your home or do you rent office space?

Is your office in your home or apartment? Or did you decide to have shared office space outside of your home (which is becoming a more common option used by small business owners to “cut down” on leasing expenses”)? If you answered yes to either of these, weighing the need for Home-base and/or Property Insurance for your business is a must. Why? Because

1) your homeowners or renters insurance does not cover “home office” space. Yes, it is in your home and a part of your home; however, homeowners and renters insurance covers dwelling (as in the part(s) of the home you actually “live in”; and

2) because even if you share space, your physical property should be insured in case of fire, water, or other damages, or damage that can take place as you commute to and from your shared office space (if your shared space is not a permanently leased space). In other words, your office space and property should be safe from loss or damage.

Can you afford it?

The question you should ask yourself is, “can I afford not to have it?” It is no secret that people are suing over the smallest (and sometimes the most unusual) reasons these days, and as a small business owner, not knowing can be costly. Whether rational, irrational, unusual or not, court costs alone can make thing difficult for a small business to bounce back from. Ensuring you are covering the bases to protect yourself, your brand, and your business should be your first order of business.

As I stated above, consult with a legal adviser (preferably a business attorney) or an insurance agent for more information on what type of insurance would suit your small business needs. I want to add, some legal consultations are free; as well as, speaking to an insurance agent is free. At the end of those discussions, you may find an affordable solution to ensure you and your business are protected.