The business structure refers to the legal structure of a business. In the early stages of building a business, you need to decide how you want it to be structured.

What are common business structures in Australia?

In Australia, there are four main types of business structures, including:

- Sole Trader

- Partnership

- Trust

- Company

Each business type has different responsibilities for owners, costs, legal and tax obligations.

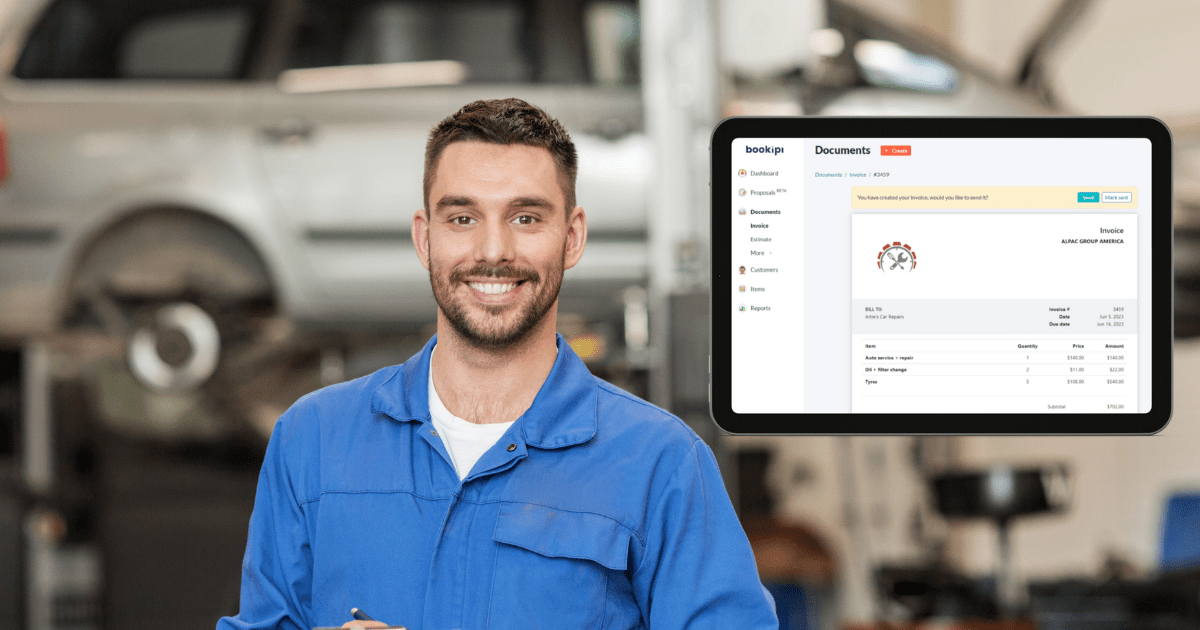

When deciding which structure is the best for your business, it helps to weigh up the pros and cons.

We cover the most common type of business structures in Australia and their advantages and disadvantages in our guide below.

Sole Trader

A sole trader is the most simple, convenient, and cheap business structure.

The sole trader (or single owner) of the business controls and manages the business on their own and is entirely legally responsible.

Being the sole trader can be extremely rewarding, but it can almost come with significant pressure.

Advantages:

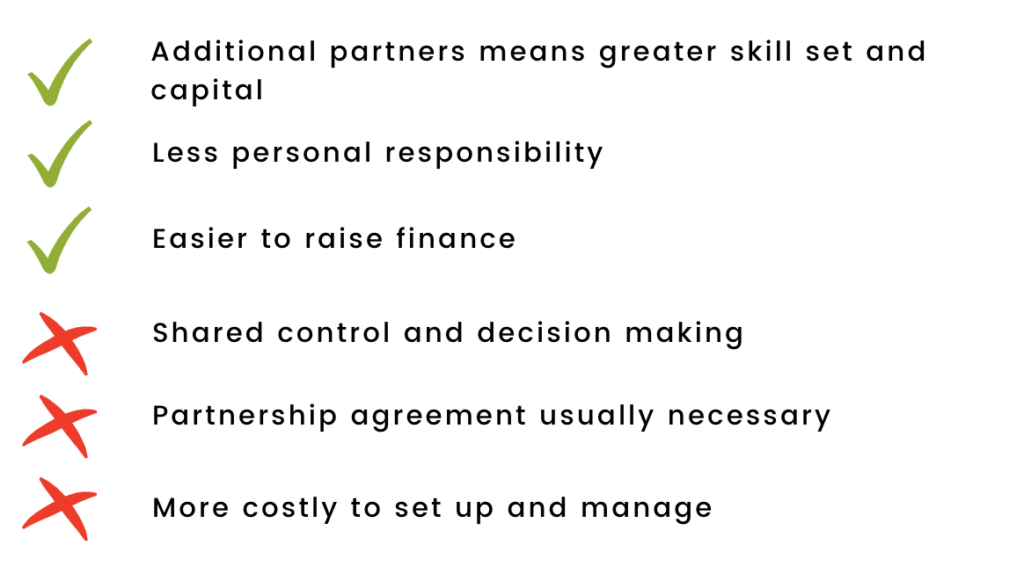

Partnership

A partnership is formed when two or more people operate a business and share the income.

This structure is useful to share skills and assets to improve the business.

Partnerships also distribute the responsibility and risk for the owners.

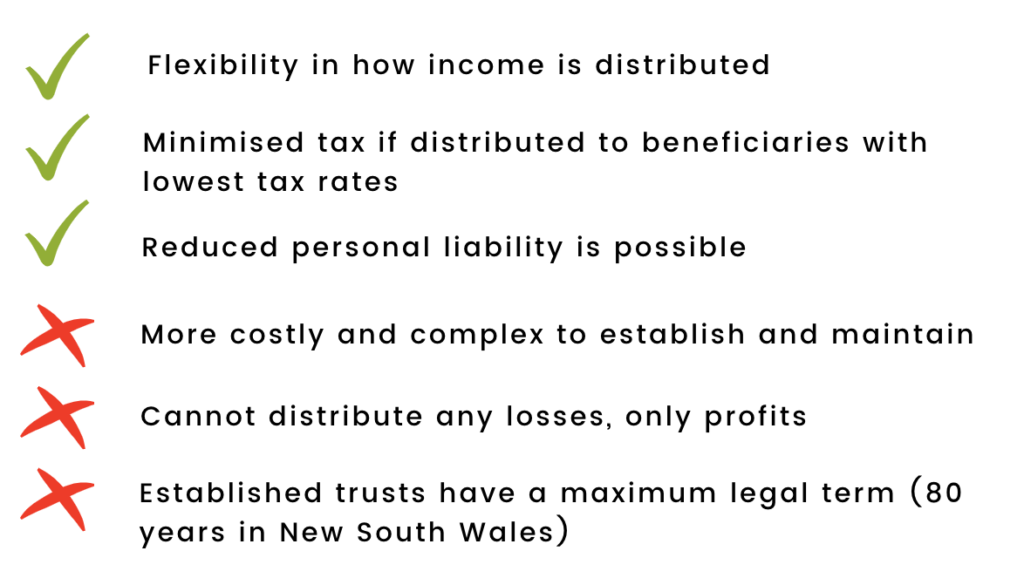

Trust

A Trust is a business structure that manages funds and assets and can invest on behalf of beneficiaries.

This type of structure is commonly used to protect, manage and pass on assets down in families.

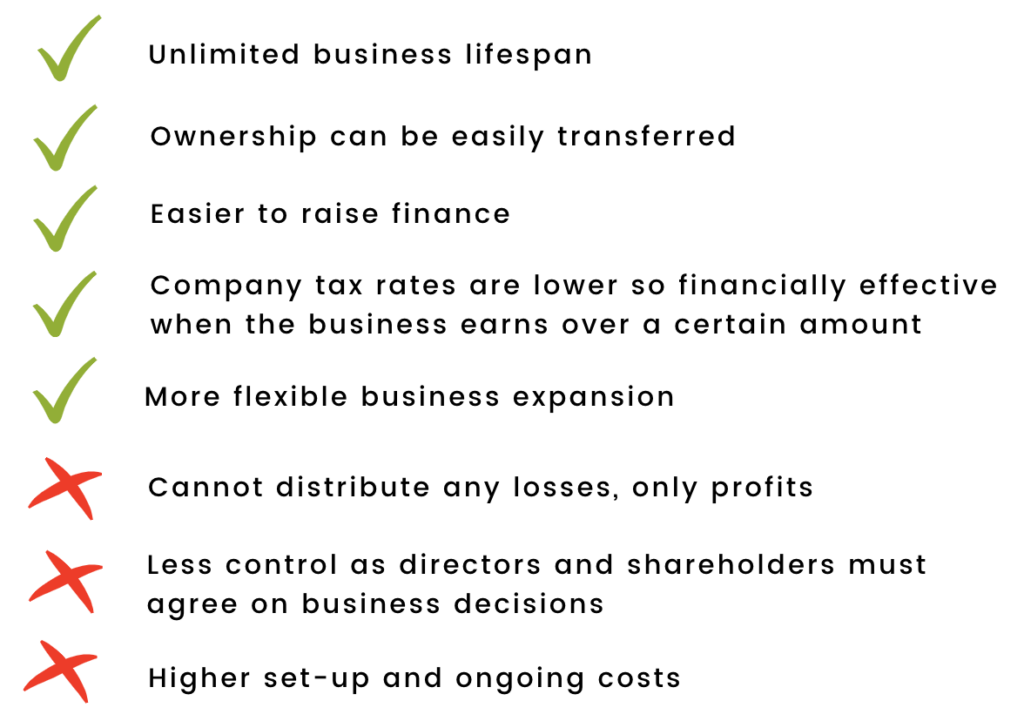

Company

When a business owner/owners legally register the company, this reduces individual liability for the owners.

This means if the company incurs debts or is sued it does not solely fall on the directors or shareholders.

This business structure is more costly and complicated to set up but is highly beneficial for tax-purposes once the business starts turning over a certain amount.

This structure is also ideal for a business that wants to be able to easily introduce additional owners, investors, and shareholders.

Get small business tools to save you time

For easy invoicing on the go, try Bookipi Invoice for free.