“YOU’RE HIRED!” Those words are every business owner’s dream to say to someone; but unfortunately, it does not come that easy (no matter what type of business you have). Interview after interview after interview after exhausting interview…and guess what, for several reasons, you may not find a suitable person to fulfil a required vacancy in your start-up.

The real question to ask yourself is: are you sure you know what you are looking for? There is so much to consider when seeking the right “fit” for your start-up and it begins with knowing your options and what it can and will mean for your small business (especially in the start-up phase).

Here are the top seven hiring types every start-up should know about before making the decision to hire:

1. The Generalist

I call this person the “do all, be all” because their knowledge and skill-set is very diverse. Hiring a generalist provides the flexibility of combining many roles and/or duties; therefore, saving many costs for your start-up. A few examples of this would be an administrative assistant that can standardize business processes; as well as, do light accounting/financial management and invoice reconciliation. Another example would be a sales consultant. While it may seem as though this position would be a specialty, a sales consultant is knowledgeable and skilled in customer service, sales, purchasing inventory, and marketing.

2. The Specialist

A specialist is a subject matter expert (SME) in a particular area. Most common positions SMEs fall under are accountants, business attorneys, website coders, and IT specialists. Another example would be a technical writer having the diversity to write contracts, partnership agreements, website content, company blogs, and any other business-related documents. Of course, this list is longer, but these are just a few of what I consider essential for start-ups. Often specialists are more expensive because they are restricted in their knowledge and technical expertise; which usually comes from both education/certification and experience.

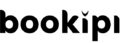

3. The Independent Contractor

![]()

An independent contractor (IC) is known as a nonemployee. even if they are working full-time hours for your start-up. These are hires that are contracted for a specific purpose or specific project for a limited duration of time or on an as-need basis at a negotiated rate. The benefit of hiring an IC is the removal of the legal responsibility of providing benefits (i.e. any tax withholdings, benefit withholdings, etc) and making it their responsibility. A bonus to hiring an IC is the ability to terminate the contract if the work to be performed is not to the agreed standard or at times, without cause due to lack of funds to continue work. I want to note, it is vital to have a contract which is inclusive of a termination clause. I will also add, never sign or initiate contracts without some type of legal review.

4. The Freelancer

I consider a freelancer to be the “commitment-phobe” of all hiring types. You know, the type of person that dislikes doing the same thing(s) over and over, or hates being in an office day in and day out, or just prefers the freedom to do what they want when they want. They can choose as many clients or companies to work with, work on specific projects of their choice, are not bound by an hour or wage requirements, and have the flexibility to work from many different locations. I mean, seriously, it sounds like a great “gig” to me.

But how does a freelancer benefit you as a start-up? First and foremost, you get a skilled expert for one-time or short-term projects. Think about it, will you always need a graphic artist for a logo once it is designed? The answer is no. And just like that, there will be many one-time expenses every start-up will incur and this is a way to fulfil those requirements. Depending on your business type, another benefit to using a freelancer is to manage work overflow.

5. The Intern

An intern is often considered “free labour”(unless paid); which let’s be honest, sounds great when you are just starting your business and are seeking ways to cut costs. But before you get too excited regarding this type of hiree, here are some realities you have to weigh when making a selection:

- Be prepared to provide a lot of time giving instruction or training. Though an intern may be free, your time is money.

- Interns may lack the experience you are looking for at a start-up phase of business. Does this hurt you or harm you as a start-up?

- Because interns are often unpaid, the longevity of an intern is often nonexistent (unless you have the ability to offer pay after a certain period of time).

- The time you spend training the intern gives them the experience to leave for another business if offered wages shortly after interning for you.

- Skilled or educated interns are rarely committed to working long hours; which depending on the need may slow progress in a start-up.

While there are many pros to hiring an intern, it is important to know what to expect beyond the free labour and experience when determining employment needs for your start-up.

6. Part-Time

A part-time is an employee option when you do not have a need to have someone work 40 hours or more a week. Often, part-time hours consist of 15-30 hours a week, but of course, this would be contingent upon what the position a part-time person will fill. Part-time also allows for flexible working options since the hours are minimal each week. Hiring a part-time person also yields cheaper costs because you are not legally required to provide or pay for benefits. Though benefits are not required, employers with part-time employees are required to withhold taxes for social security, federal, and state (where applicable).

7. Full Time

This hire is by far the most expensive hire decision; though in many cases provides more long-term continuity. Why? Because 1) legally you are required to provide benefits, 2) most states have minimum wages that must be paid so even those with no work experience may get a decent pay wage, and 3) most full-time employees stay in positions longer than part-time employees or interns. When considering full-time employees, it is important to have an accounting specialist to ensure payroll and employee accounting are properly handled. Like part-time, employers with full-time employees are required to withhold taxes for social security, federal, and state (where applicable). Other costs incurred with full-time employees are workman’s compensation, health and dental benefits, and other deductions (i.e. Medicaid, unemployment, etc.).

As you can see, there are many options to consider as you decide on the structure of your start-up. There is no one size fits all, but you at least know how to utilize this information to ensure your mission and vision is accomplished not only short-term success but long-term growth.