There are a few things that come to mind when starting a business. One of the most important things is finding the most effective way to get paid. You may think the decision is easy. However, there are many things to consider when determining the most effective way to receive payments or send invoices.

Many small businesses sign-up for web bookkeeping software (i.e. Quick Books, Freshbooks, Accounting Pro, etc.) with invoice capabilities. However, these large accounting packages are not catered to invoicing and are expensive if you don’t need their core accounting features.

Some small businesses still manually issue paper invoices or payment receipts. However, there are many benefits of using an automated invoice generator for your business. What is more impressive, is how an invoice generator can actually grow your small business. In business, growth is not just financial. It is efficiency. It is convenience. It is having the ability to increase your bottom line by tracking trends. Most of all, growth is an improvement.

Below are five benefits of using an invoice generator to grow your small business:

Benefit 1: Invoicing anywhere, anytime

Are you a business that frequently participates as a vendor at events? Are you a new or existing self-published author that travels for book signings? Are you a business that is able to provide mobile services to clients? Are you a business that only accepts cash and has time balancing cash flow at the end of each day? Do you have to accept fewer payment amounts because someone does not have enough cash and you do not accept credit cards? Is your business unconventional and more of a paid hobby?

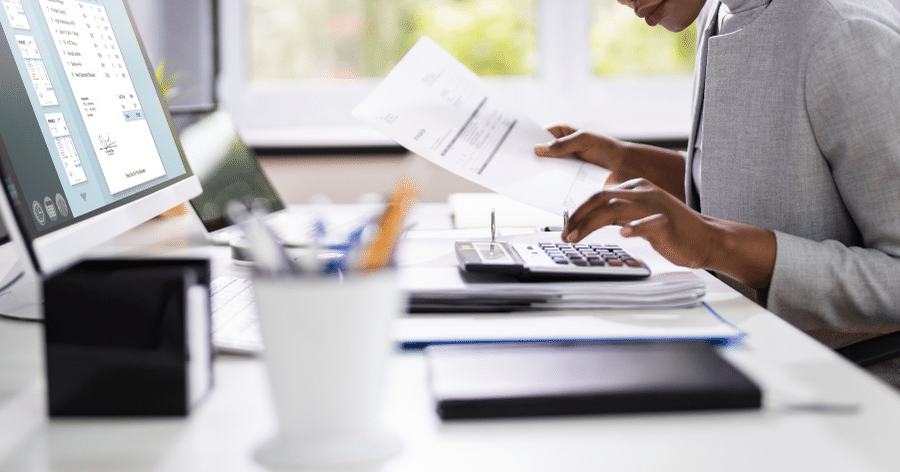

If you answered yes to any of these questions, invoice software like Bookipi invoice app can grow your small business by saving you time and ensuring you can follow up on client payments. Learn how to use Bookipi Invoice on web app or mobile app with our simple user guides.

Benefit 2: Get paid by clients on time

With Bookipi’s integrated card payments, your clients can pay you for your products or services direct from invoices that you have sent. Having the ability to accept payments anywhere and at any time does two things:

- Generates more business revenue and;

- Immediately provides tracking and filing of that payment. It is a stress-free way to manage a business on the go. As invoices are automatically stored in Bookipi invoice app, you don’t have to worry about them until you are reconciling your financial accounts.

Benefit 3: Automatic receipts

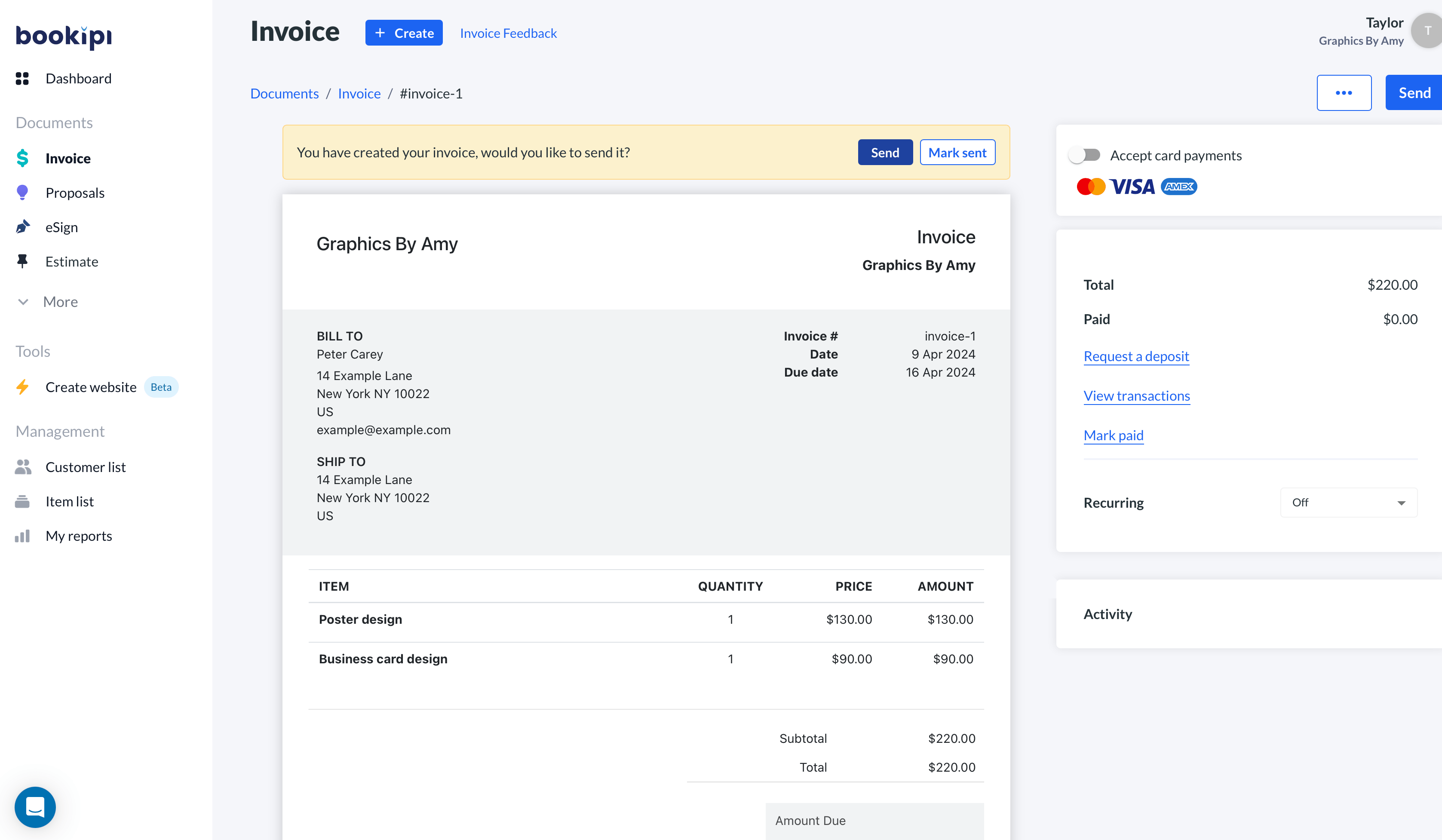

Are you the type of business owner or entrepreneur that carries around your product(s) and sometimes make sales “on the fly”? Using an invoice generator allows you to accept cash and treat the invoice as a receipt.

On the other hand, not everyone carries cash these days and rely on the ability to use their debit or credit cards. With Bookipi’s invoice app, you’re able to receive card payments direct from invoices, and provide an electronic receipt. There’s nothing better than being totally paper-free and efficient when it comes to running your business.

Benefit 4: Think “green”

Using an invoice generator not only saves on time, but also saves on the costs of paper, stamps, and/or envelopes. Even more so, having a paperless method for invoicing eliminates the need for filing and storage (after all, most invoices, receipts, and business tax financials have to maintain for 7 years). Have you seen what happens to the ink on invoices or receipts after a few months, let alone a few years? It fades away. They certainly don’t make ink like they used to!!

I used to be the type of person that would hold on to all of my paper receipts and now I have to take pictures of them or scan them when I make some business purchases. To be quite honest, I find this daunting and time-consuming. Now, I ensure that most business transactions can be made via the web or through an electronic method of receiving receipts. One last benefit of being completely paperless is the ability to have transparency between you and your accountant or you and your administrative assistant.

Benefit 5: Bookkeeping & accounting accuracy

The last benefit of using an invoice generator to grow your small business is for accounting accuracy. One of the easiest mistakes small businesses make is not doing proper bookkeeping for taxes and internal business decision-making.

As a small business owner, making quarterly or annual tax payments is daunting but mandatory. Most invoice generators have the ability to track revenue monthly, quarterly, or annually. Another benefit is having an all-in-one invoice maker and organizer. As invoices are stored electronically in our cloud software, you can provide invoice records to your accountant or tax preparer through our simple export functions. Tracking revenue, taxes, and expenses is an important but often neglected consideration for having an invoice generator.

Having a small business is difficult enough. Why not free up some of your time using our free invoice mobile app for enhancing your business?