Invoice Reconciliation is the process of matching incoming and outgoing invoices to your bank statements.

The process helps businesses and their accountants stay organised and ensure that all book entries are matched.

Invoice reconciliation requires two sets of records and making sure that they agree.

After invoice reconciliation, your invoices and bank statements must be balanced at the recording period.

As a business owner, you need to know that the money leaving your account matches the money that your invoices are saying you sent.

This makes invoice reconciliation an important business process.

How to do invoice reconciliation

Invoice reconciliation is important for maintaining your accounting records and avoiding fraud.

By managing your bank statements and invoices, you’ll be able to better manage who has and has not paid you as well as who you have paid and are yet to pay.

Some ways to make invoice reconciliation easier include:

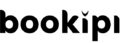

1. Use invoicing software

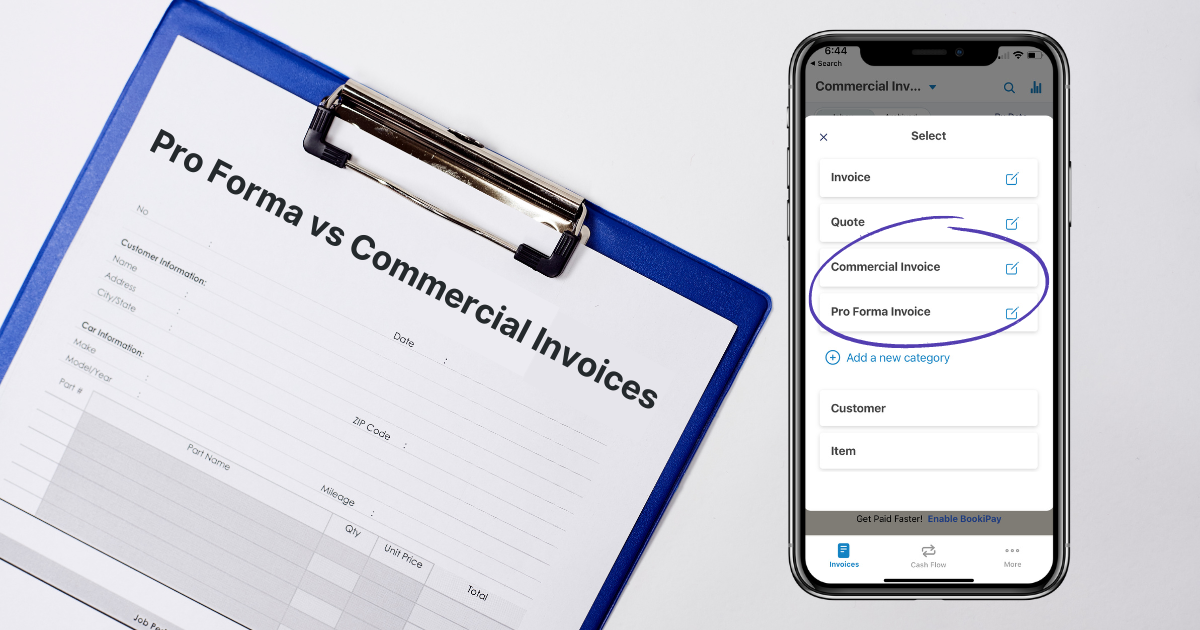

Invoicing software saves you time which as a business owner you probably don’t have a lot of. With invoicing software like Bookipi, you can match invoices stored in one central spot, with income and expenses using a cash flow manager.

If you aren’t using invoicing or expense software, you might want to consider using them for future invoices as it will speed up the process.

2. Implement processes for invoice reconciliation

Good admin processes makes invoice reconciliation a quicker process. Set up a system that will organise your invoices and bank statements in a way that you understand.

Invoicing software like Bookipi invoice app is an all-in-one invoice maker and organizer. You can organize invoices by invoice number or issue date and generate reports, instead of using spreadsheets to manually keep track of invoice amounts. With Bookipi, you can make invoices quickly, store invoices in one spot and search invoice history.

The more organised your admin is, the less time you will need to spend sorting through invoices and transactions when you reconcile your invoices.

For expense tracking, it can be helpful to learn how your suppliers structure their invoices. This will make it easier for you to reconcile invoices from suppliers when your business is the client. .

3. Make a list for invoice reconciliation

It can be hard to keep track of everything in your head.

If you write down a list of different things to think about, you eliminate errors and reduce the amount of time you spend doing invoice reconciliation.

Items to cover for invoice reconciliation

- Are there any bank fees involved? Were bank fees paid on top of the amount in the invoice or included? Are there multiple fees involved including currency conversion, credit card fees and more?

- Are there any outstanding balances to be paid?

- Were there any discounts applied?

- Have you been overcharged or undercharged? Has someone overpaid or underpaid you?

- Was any amount rolled over from a previous balance?