By Arabella Walton

Do you struggle to identify the best ways to track business expenses? If so, you’re not alone!

Studies show that tracking business expenses and money management are some of the biggest struggles small business owners face today.

As a small business owner, you have lots of expenses to manage and little money to waste on fancy programs or employees to help you with expense tracking.

That’s why we’ve decided to make life a bit easier for you by sharing our best tips on how to track business expenses in a cheap and easy way.

Open a business bank account and have a business card

Once you’ve started your business, it’s important to create a new bank account to ensure the separation of your business and personal accounts. Separating your bank accounts not only helps with organising your finances but also makes things easier when it’s tax time.

Additionally, opening a business credit card is also a great idea to avoid confusing your personal and business finances. Jump onto your bank’s website and see if they offer business credit/debit cards. If your bank does not offer this service, MasterCard is a great option. They offer specialised cards for small businesses as well as mid-large business.

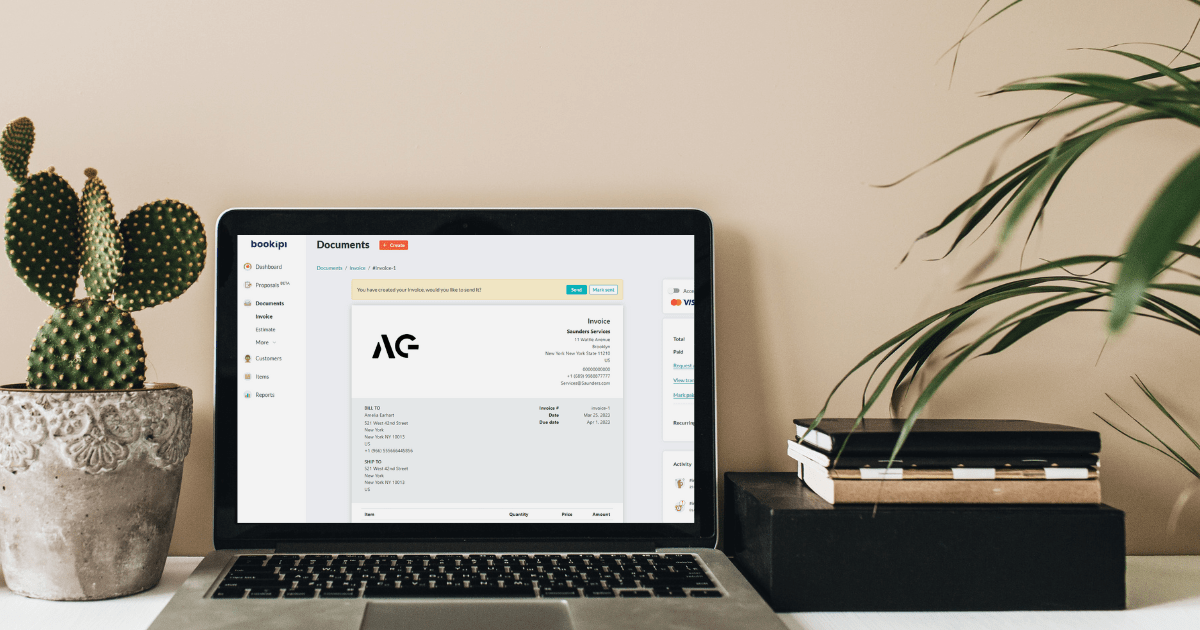

Download an expense tracker

Using an expense tracker is one of the best things to help you get on top of your business expense management. They are accessible on all platforms such as mobile, laptop or tablet and track your expenses instantly, requiring no manual backups!

We might be slightly biased but we think Bookipi Expense is one of the best apps for business expense tracking. Simply log the expense into the app and all the calculations are done for you! Another great feature of Bookipi Expense is its ability to sync with Bookipi Invoice app so you can keep invoices and track expenses all on one platform.

Scan your business receipts

Another important step in successfully tracking your finances is scanning and tracking receipts from business expenses.

As suggested earlier, having a business credit or debit card makes keeping track of your receipts one step easier. If all expenses are from the same account and card, it’s easy to keep track of them. Simply scan all receipts from purchases made on your business card onto your expense app, phone or computer.

Bookipi Expense is our recommendation for scanning and tracking your receipts. Simply take a photo of the receipt when you log the purchase in the app.

Record all income and track expenses as you go

Keeping track of company income and expenses is key for every business. However, achieving this can become difficult if you do not record as you go. By noting all income and expenses immediately you will create an efficient money management structure for your business. Using Bookipi, you can track expenses and invoices paid, wherever you are on mobile app, with our user guides.

Know which expenses are tax-deductible

Understanding which business expenses are tax-deductible and which are not is crucial when managing your finances. This will help you save money and track your spending more efficiently.

Some common tax deductions include:

- Vehicle and travel expenses

- Clothing, laundry and dry-cleaning expenses

- Home office expenses

- Self-education expenses

- Tools, equipment and other assets

- Other work-related deductions

To find out more on which business expenses are tax-deductible visit your country’s Taxation Office website.

Tracking business expenses and successful money management are some of the main challenges for small businesses. Here at Bookipi, our aim is to make the business lives of small business owners easier. These tips have helped you gain insight into how to track business expenses and manage your money.

Tracking business expenses and successful money management are some of the main challenges for small businesses. Here at Bookipi, our aim is to make the business lives of small business owners easier. These tips have helped you gain insight into how to track business expenses and manage your money.