There is a buyer and seller in every business transaction. The seller may be a freelancer or business that provides goods or services to a customer for a fee.

It’s this transaction that brings up questions. How do you make an invoice? How much money does the buyer owe? What exactly are they paying for? How will the payment be made?

To answer these questions, the seller sends the buyer an invoice. An invoice is a legal document that outlines the total cost, all of the goods and services provided and the terms of the transaction.

Why are invoices important?

Invoices are necessary for small businesses, freelancers and contractors. Invoices are the business documents that gets sellers paid and helps the buyer make the payment.

Small businesses get paid

If you’re a seller or service provider, you want to get paid and paid correctly. As a small business, sending invoices to customers early means you get paid quicker. The longer you leave invoicing, the longer it will take for you to get your money.

Laws requiring invoices

Governments often have laws that require invoices for any transactions involving registered businesses. Most countries will charge some sort of sales tax on any transactions involving taxable goods and services. Sales taxes can include state or provincial taxes, GST and VAT. Invoices act as records of transactions and can help you obtain tax credits and refunds.

More accurate records and accounting

Invoices are also important when it comes to maintaining accounting entries for buyers and sellers. As a business, you can use invoices to track accounts receivable and accounts payable.

How do invoices work? What are invoices used for?

Invoices are used to document the transaction being made and the services provided.

Businesses can use invoices to:

- Request a payment from a client

- Keep track of items or services purchased

- Keep a record of a transaction

- Calculate business revenue for tax purposes

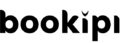

Example of an invoice

What is on an invoice?

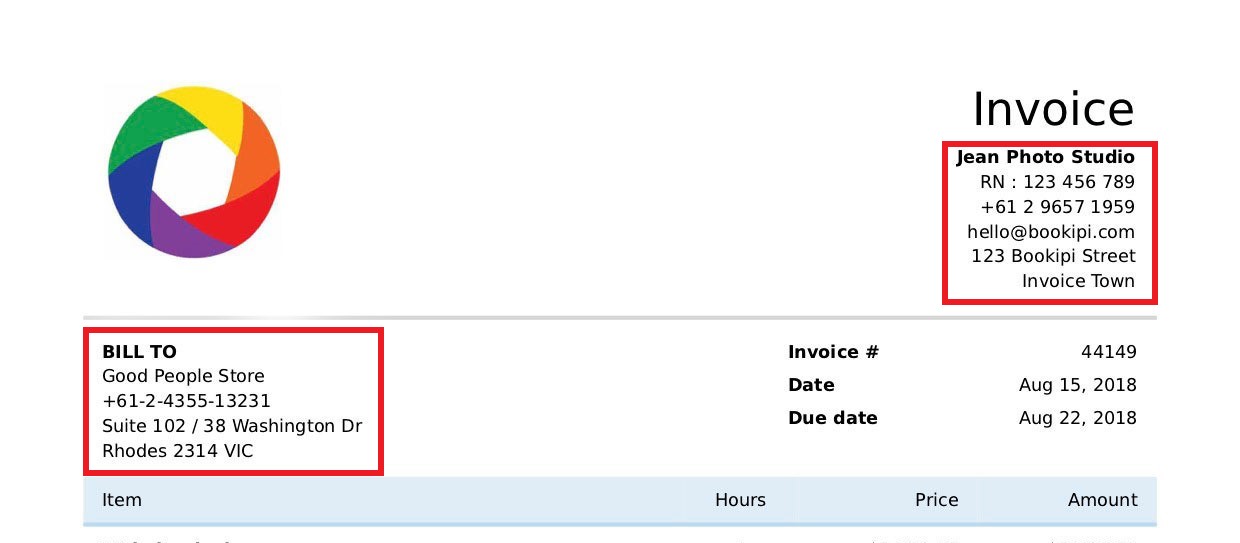

This invoice example below is created with our invoice generator.

A breakdown of the key features that an invoice should include is as follows:

Names and contact details

The first part of any invoice is the name, address and contact details of both the buyer and seller. Our invoice example below shows that you must clearly outline who the transaction is between.

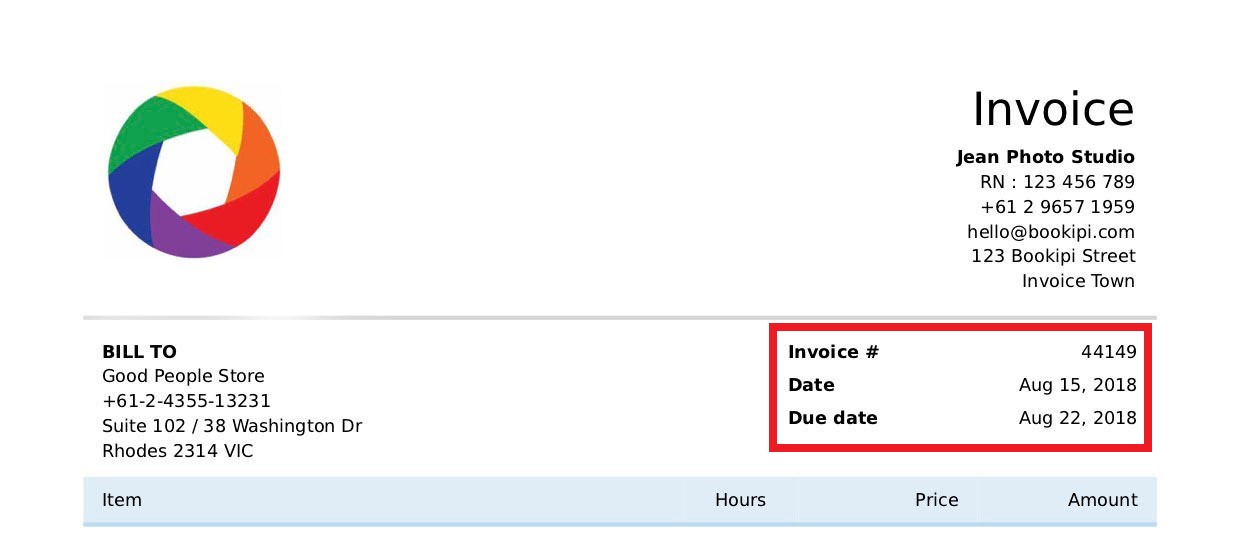

Invoice details

It’s important for small businesses to use invoice numbers for tracking and invoice management. Normally, invoice numbers are sequential so it’s likely that the next invoice’s number will increase by 1. Bookipi Invoice automatically assigns invoice numbers for your invoices for easier record-keeping.

Next, you should list the date that the invoice was created. The invoice creation date starts the countdown for when payment is due from your customer.

Then, it’s the invoice due date for payment of the invoice.

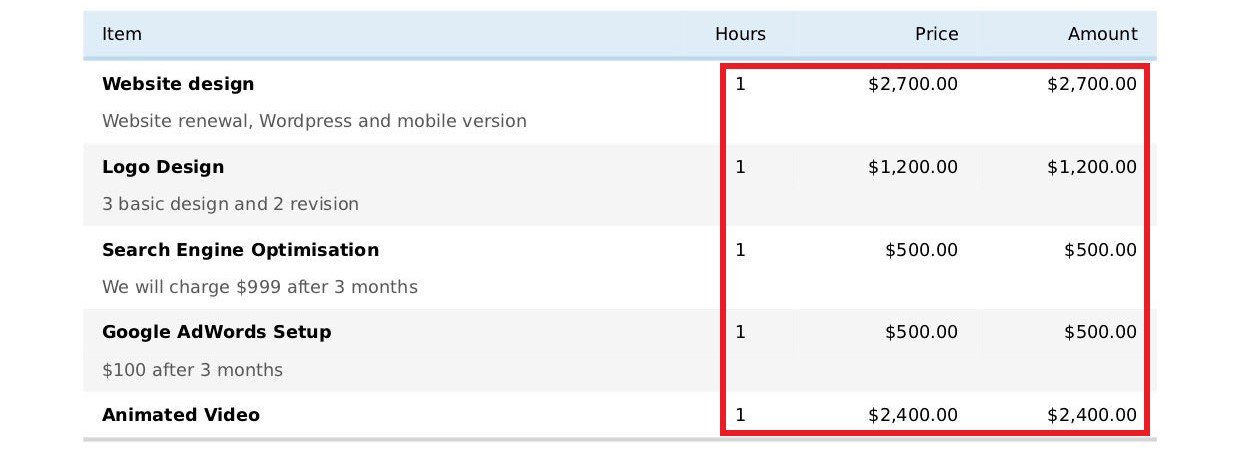

Goods and services description

In this section, list and describe the goods and services that have been provided. It’s best practice to enter separate line items for the description of goods and services provided to ensure your summary is clear and detailed.

Costs and rates

In this part of the invoice, show the hours/quantity, rates and total costs for each product or service. This helps the customer really understand what they are paying for.

You can edit this section depending on whether your business is charging based on the number of goods sold for products and the number of hours worked for services.

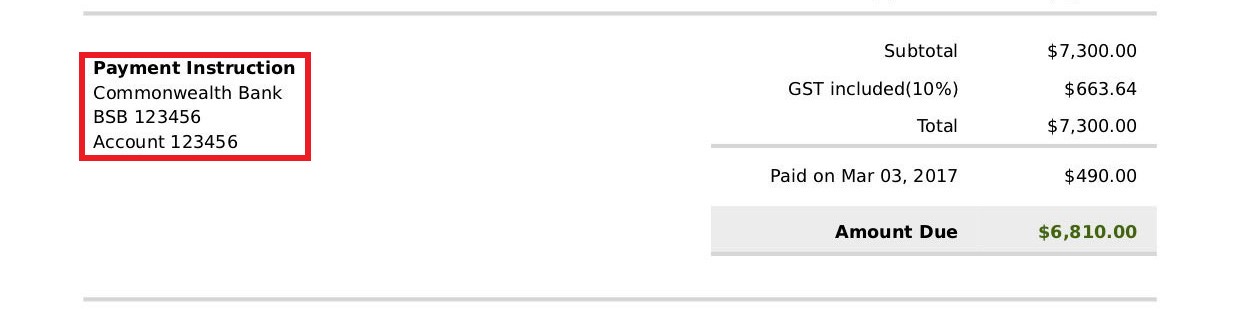

Totals

Include the total cost of the goods and services in this section. Here, your customer can see exactly how much they owe you in total. You can also include sales taxes such as VAT or GST. Any payments that have already been made by the customer including deposit amounts can be included in this section of the invoice.

Payment instructions

Your business can add payment instructions including preferred payment methods and bank details for customers to pay your invoice. You can include any other instructions for making a payment.

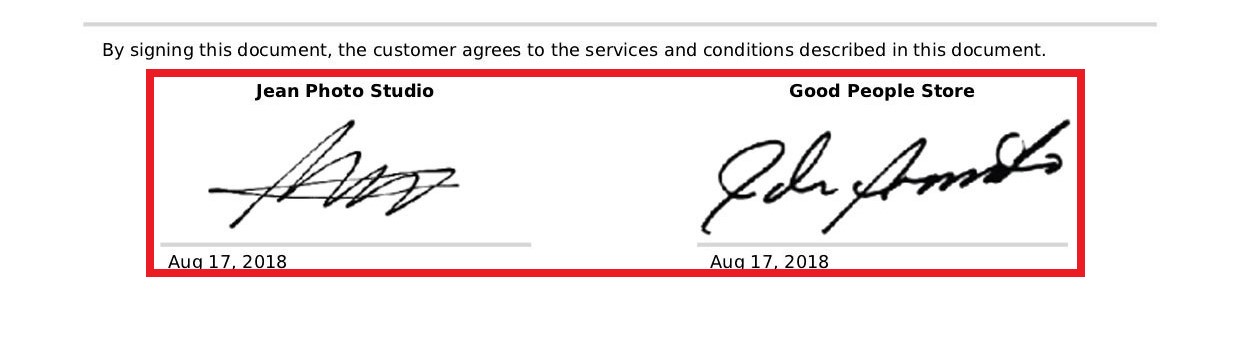

Signatures

Not all invoices will include a signature. Your business can easily include signatures to show that there has been an agreement made between your business, as a seller and your customer as a buyer.

Types of invoices

Standard (or Sales Invoice) Invoice: This is the most common type of invoice, used to bill a customer for products or services rendered. It typically includes information such as a description of the items sold or services provided, quantities, prices, total amount due, payment terms, and seller and buyer details.

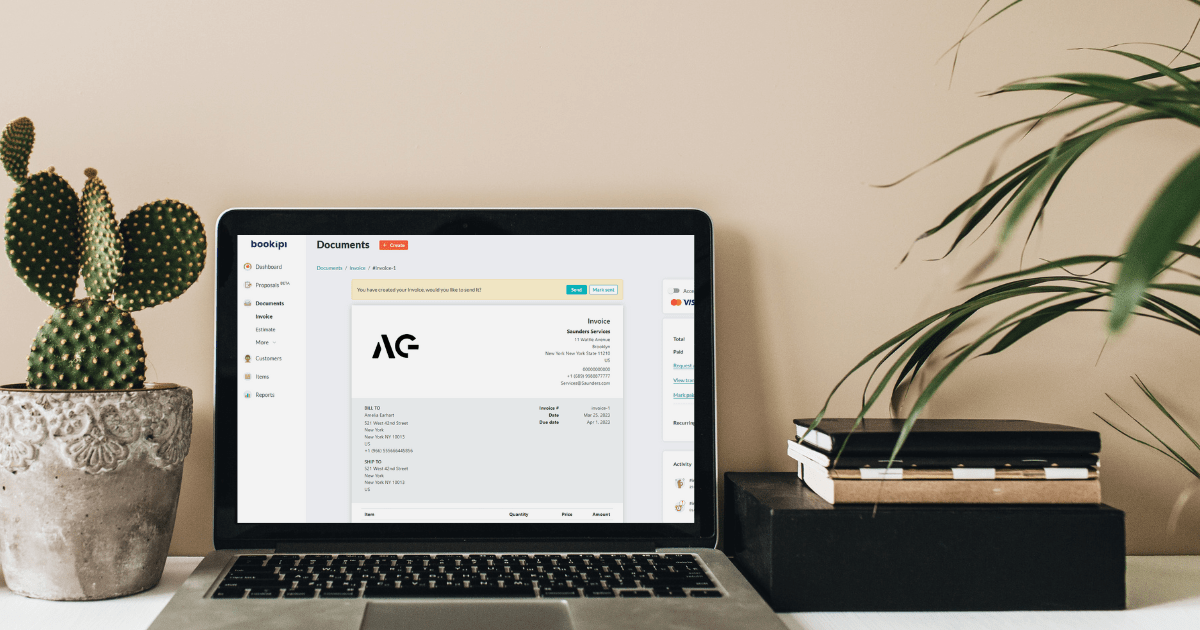

Proforma Invoice: A proforma invoice is a preliminary bill of sale sent to buyers in advance of a shipment or delivery of goods or services. It outlines a commitment from the seller to provide specified goods or services at a specified price and terms.

Commercial Invoice: This type of invoice is used for international trade and includes additional information required by customs authorities, such as the country of origin, harmonized system (HS) tariff codes, terms of sale (Incoterms), and any applicable taxes or duties.

Credit Invoice: Also known as a credit memo or credit note, this document is issued by a seller to reduce or cancel the amount owed by a buyer. It may be issued for various reasons, such as returns, discounts, or billing errors.

Recurring Invoice: Recurring invoices are used for billing customers on a regular, recurring basis for subscription-based services or ongoing contracts. They are typically generated automatically at predefined intervals, such as monthly or annually.

Interim Invoice: An interim invoice, also known as a progress invoice or partial invoice, is issued for partial completion of a project or delivery of goods. It allows the seller to bill the buyer for work completed or goods delivered up to a certain point, with the final invoice issued upon completion.

Time-Based Invoice: This type of invoice is used for billing based on the time spent by a service provider, such as consultants, freelancers, or lawyers. It includes details of the hours worked, hourly rates, and any additional expenses incurred.

Debit Invoice: Similar to a credit invoice, a debit invoice is issued to increase the amount owed by a buyer. It may be issued to correct underbilling, add charges for additional goods or services, or adjust for previously issued credit invoices.

These are some of the most common types of invoices used in business transactions, each serving a specific purpose depending on the nature of the transaction and the relationship between the buyer and seller. We’ve also created invoice templates for various uses that you can download for free.

FAQs on invoices

What do invoices mean?

Invoices formalise a sale. An invoice contains a detailed breakdown of goods and services with pricing. A transaction is complete once a customer makes payment for the goods and services as set out in an invoice.

Are invoices legal documents?

Is there a difference between an invoice and a bill?

Invoices and bills are important business documents around customers paying for goods or services. The terms invoice and bill are often interchanged. However, there are some key differences.

Invoices are requests for payment from a customer by suppliers. An invoice is a document that usually contains a detailed description of the items or services provided, the quantity, the price per unit, and the total amount due. Good invoicing practices often include payment terms, such as payment due dates and discounts. Invoices are usually sent before payment is made.

A bill is typically seen as a demand for payment. Bills often contain the same information as an invoice but often include legal language about non-payment consequences. Bills are more formal and are sent after goods or services have already been provided.

When should I issue an invoice to a customer?

How long should you give a customer to pay an invoice?

Your business’ earlier discussions with a customer is the most important factor when considering the best amount of time to allow for invoice payment . Your customers should be informed of your payment terms in advance. Payment terms may include any late fees or interest charges for late payment. Early notice of invoice payment terms helps prevent misunderstandings or confusion by customers. We know how awkward it can be to ask for payment that we wrote an article on just “How to ask for payment (without being rude)”.

Invoice payment terms vary, but it’s worthwhile thinking about your business needs and standard industry practices. Common invoice payment terms include ‘net 30’ or ‘net 60’ which means payment is due 30 or 60 days after invoice date. You can also set due date reminders that will automatically send an email to your customers when it has passed the set due date on our online invoice software.

For timely invoice payments, you should include a specific date for payment to be due on an invoice. Your clients should be notified promptly if you haven’t received payment by the invoice payment due date. Your invoice should specify any terms and conditions around non-payment. This may apply and you may consider taking legal action after repeated failed attempts to collect payment.