What is a proforma invoice?

A proforma invoice is a preliminary bill of sale that you send to your client before the work has been completed.

You can see it as a commitment to goods or services that are yet to be delivered.

It should list the work to be completed under the arrangement with your client as well as the quantity of work and the price.

A proforma invoice is neither an invoice nor a request for payment so it cannot be used for accounting purposes.

It is used commonly as a quotation or for customs purposes on imports.

What is a proforma invoice?

A proforma invoice is issued before a job is complete. It is an estimate or quote that outlines the goods and services that a seller will provide to their customer.

Pro forma invoices are sent before the goods and services are delivered.

The main purpose of a proforma invoice is to ensure that the seller and their customer are aligned on their agreement, especially about the price of the goods and services.

It should give an overview of the costs and quantities of the products and services.

This is different from a proforma document which does not include prices.

What is the purpose of a proforma invoice?

Proforma invoices serve a variety of purposes.

They ensure that the seller and buyer are aligned on their agreement, especially about the price of the goods and services.

Pro forma invoices also help to streamline the sales process.

As a seller, you send the proforma invoice to your client who then agrees to the price.

You then provide the goods and services and issue an invoice for the payment.

Essentially, they act as an estimate so your customers know what to expect.

Other purposes they serve are:

-

- Pro forma invoices declare the value of goods for customs for an easy delivery process

- Pro forma invoices are issued when you don’t have all the details needed for a commercial invoice

- Clients use pro forma invoices to get internal purchase approval

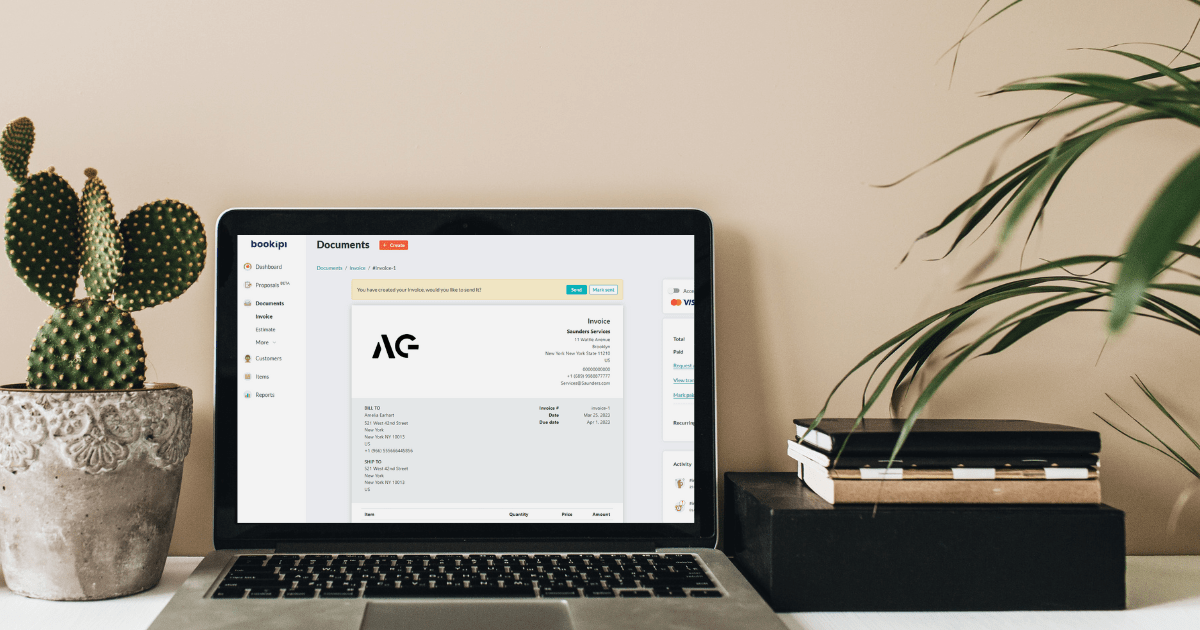

What's the difference between a pro forma invoice and standard invoice

An invoice is a commercial document that outlines what goods and services were provided and the total amount due for those goods and services.

A proforma invoice is like an estimate and details the goods and services that will be provided to a seller. A proforma invoice is sent before the actual supply of goods and services and tells a customer what they can expect. Find out the differences between pro forma and commercial invoices in our detailed tutorial.

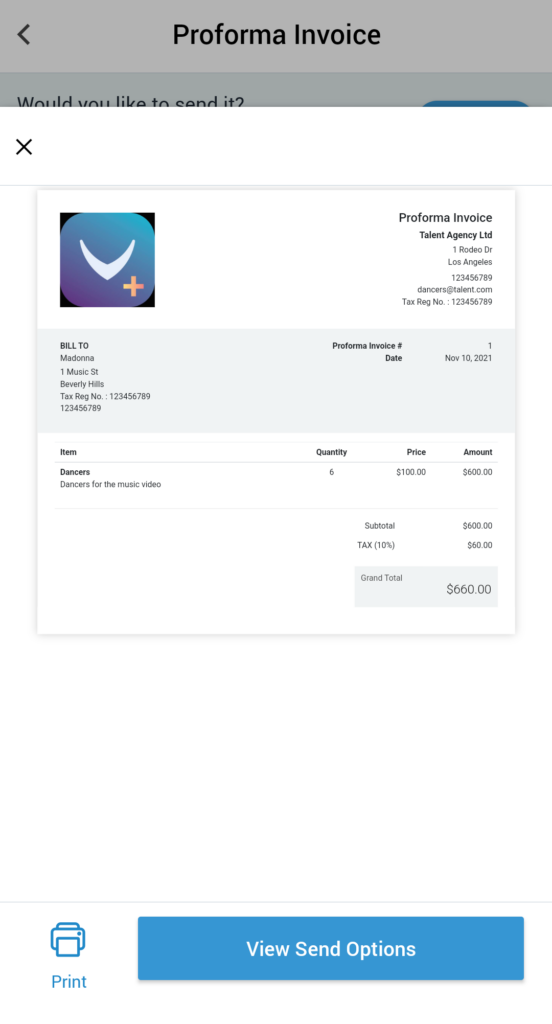

Both pro forma invoices and commercial invoices are formatted similarly. Both show the same information including business logo, contact information, billing addresses, information about the goods and services, costs, as well as terms and conditions. However, a proforma invoice should be clearly labelled ‘proforma’.

You can use an invoice for accounting purposes but you can’t use a proforma invoice because this occurs prior to the actual sale.

Is a proforma invoice legally binding?

A proforma invoice is not legally binding and should not be used for accounting purposes.

As it is sent before goods and services are provided, it is closer to an estimate or quote than an invoice.

No sale has occurred when you send a proforma invoice.

What to include on a pro forma invoice

The purpose of a proforma invoice is to outline the goods and services you will provide to your client. This means that it should show most of the same information as the final invoice, including:

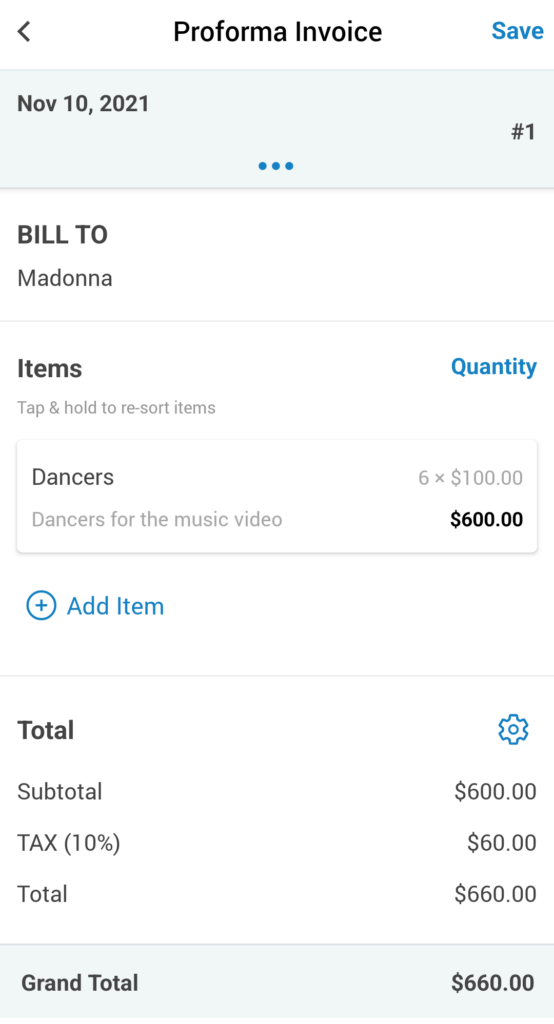

- A proforma invoice number

- Your company name, address and contact details

- Your customer’s name, address and contact details

- Invoice issue date

- The due date

- Description of the goods and services

- The price of the goods and services

- Terms and conditions

- Payment terms (this isn’t necessary but making them aware earlier may make it easier for them to pay you)

- Tax (while a proforma invoice is not a tax invoice, you should still outline the tax amount they can expect to pay)

Please note that you need to clearly display the words ‘Proforma Invoice’ so your customers know that it is not a sales or tax invoice.

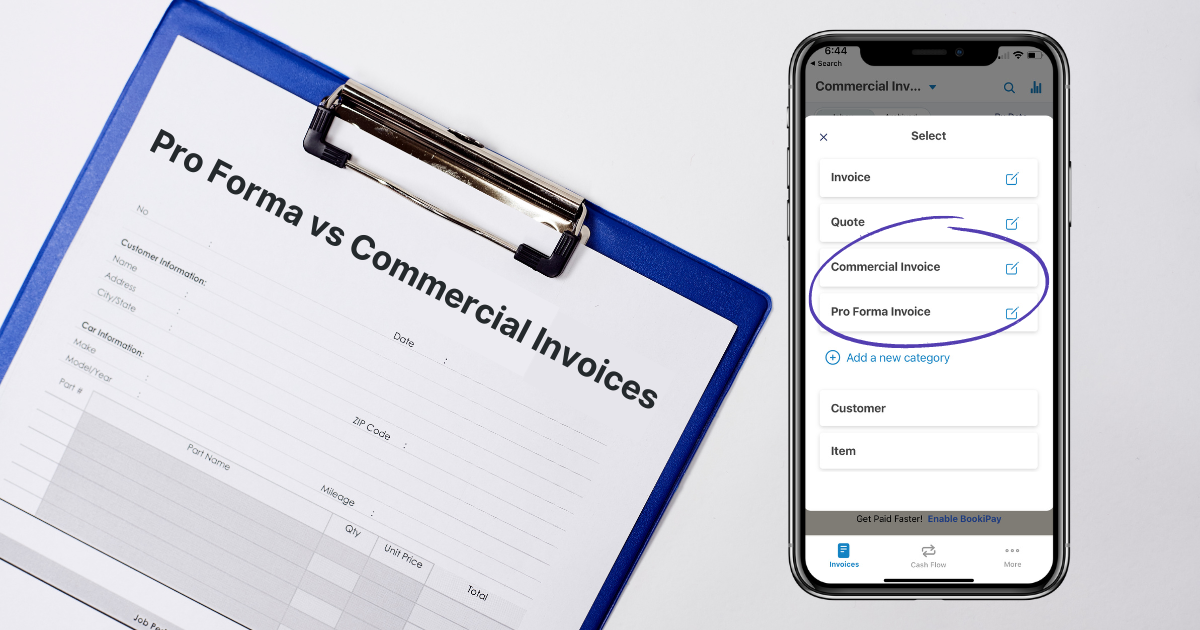

How to make a pro forma invoice using Bookipi

You can create proforma invoices and more on the Bookipi Invoice app with a few simple steps listed below:

Steps to make a pro forma invoice in Bookipi

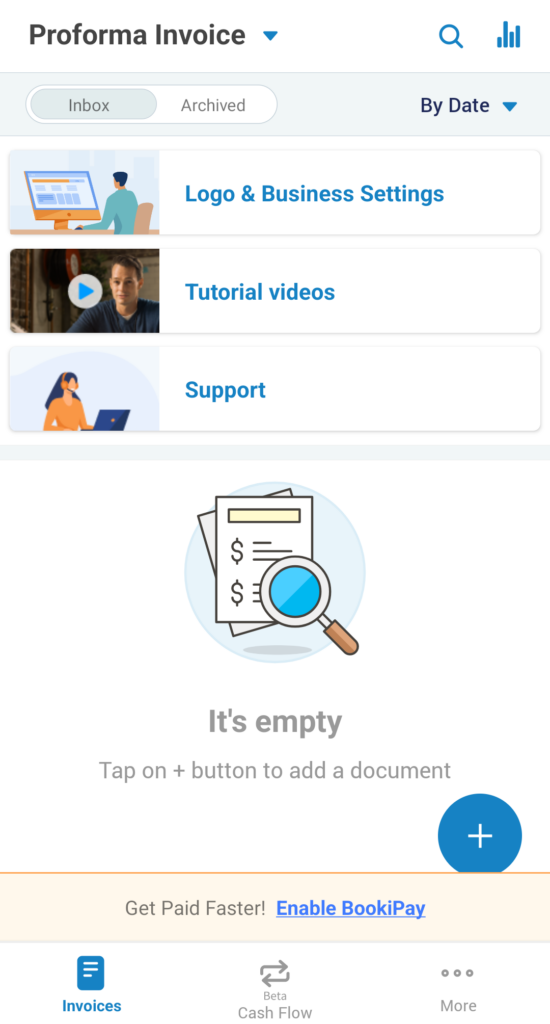

Step 1:Make a new pro forma invoice

Press the ‘plus’ button to make a new invoice in Bookipi

Step 2: Add details to your pro forma invoice

Enter the details of the goods and services you are providing.

Step 3: Send your pro forma invoice to a client

Save and/or send the invoice to your customer.

How to make a pro forma invoice with Bookipi Invoice

Try Bookipi Invoice for free to make pro forma invoices in minutes.

You can also download Bookipi Expense for free to track business and personal expenses.

Table of Contents

Explore related articles: